Table of Contents

HUT 8 (HUT) Miner Count, Gross Profit + Share Price Potential (Sept Update)

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูเพิ่มเติม

Hut 8 (HUT) provided their September mining numbers. I’ve updated my excel file to get a more accurate earning potential forecast. Look at their Q3 possible earnings and how Q4 could possibly could look like.

Thanks for watching.

HIT THE LIKE BUTTON! 👋

DON’T FORGET TO SUBSCRIBE!

Support the work that I do on Patreon: https://www.patreon.com/sebastian_

I post all of my spreadsheets, links and other useful items that I use in the videos.

Follow me on Twitter: @sebastian_ski

I post or retweet occasionally.

NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! I AM NOT AN EXPERT! I DO NOT GUARANTEE A PARTICULAR OUTCOME I HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST ENTERTAINMENT!

This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public awareness and is public domain. This information is not intended to slander harm or defame any of the actors involved but to show what was said through their social media accounts. Please take this information and do your own research.

Chỉ số tài chính: 1) Tỷ suất lợi nhuận gộp (Gross Margin)

Tỷ suất lợi nhuận gộp (Gross Margin)

Gross Profit Margin Formula | Calculation (with Examples)

In this video we have discuss Gross Profit Margin Formula along with some simple practical examples.

𝐆𝐫𝐨𝐬𝐬 𝐏𝐫𝐨𝐟𝐢𝐭 𝐌𝐚𝐫𝐠𝐢𝐧 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

Investors must start investigating at every level. He or She needs to know how every part of the company works. When an investor evaluates the statement of income, it’s not enough to check a profit ratio such as a net profit margin.

Let us look at the formula of Gross Profit Margin

Gross Profit Margin =Gross Profit / Revenue 100

𝐔𝐬𝐞 𝐨𝐟 𝐆𝐫𝐨𝐬𝐬 𝐏𝐫𝐨𝐟𝐢𝐭 𝐌𝐚𝐫𝐠𝐢𝐧 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

Return on profit is an important factor for investors. The investors mainly look at the net profit margin and also the gross profit margin. The gross profit margin calculator is useful for investors because it can be easily compared with other similar companies by calculating the percentage.

𝐆𝐫𝐨𝐬𝐬 𝐏𝐫𝐨𝐟𝐢𝐭 𝐌𝐚𝐫𝐠𝐢𝐧 𝐅𝐨𝐫𝐦𝐮𝐥𝐚 𝐄𝐱𝐚𝐦𝐩𝐥𝐞

Let us take a practical example to explain the formula of the gross profit margin.

In its statement of income, Chocolate Pastries Ltd. has the following information

Net Sales – $500,000

Cost of Goods Sold – $300,000

To find out the year ‘s gross margin. First of all, we need to find out Chocolate Pastries Ltd’s gross profit.

Following is the calculation to find gross profit.

Gross Profit = (Net Sales – Cost of Goods Sold)

= $500,000 $300,000 = $ 200,000.

So, Using the formula of gross profit margin, we get –

Gross Profit Margin = Gross Profit / Revenue 100

= $200,000 / 500,000 100 = 30%

From the above calculation of the gross profit margin percentage, we can say that Chocolate Pastries Ltd. ‘s gross profit margin is 30% each year.

To know more about the 𝐆𝐫𝐨𝐬𝐬 𝐏𝐫𝐨𝐟𝐢𝐭 𝐌𝐚𝐫𝐠𝐢𝐧 𝐅𝐨𝐫𝐦𝐮𝐥𝐚, you can go to this 𝐥𝐢𝐧𝐤 𝐩𝐫𝐨𝐯𝐢𝐝𝐞𝐝 𝐡𝐞𝐫𝐞 : https://www.wallstreetmojo.com/grossprofitmargin/

Subscribe to our channel to get new updated videos. Click the button above to subscribe or click on the link below to subscribe https://www.youtube.com/channel/UChlNXSK2tC9SJ2Fhhb2kOUw?sub_confirmation=1

GROSS PROFIT MARGIN: A Simple Explanation

💥Profitability Ratios Cheat Sheet → https://accountingstuff.com/shop

In this video you’ll learn what ‘Gross Profit Margin’ is and I’ll show how to calculate it with examples. This is the start of a new series covering Financial Ratios.

🔴Subscribe for more Accounting Tutorials → https://geni.us/subtothechannel

🔗Financial Ratios Playlist → https://www.youtube.com/playlist?list=PL5zKSeS09l32wo_GgikQ_LgYYW6YXzxDc

⏱️TIMESTAMPS

00:00 Intro

00:13 Gross Profit Margin Definition

01:02 What is Profit?

01:22 What is Profit Margin?

02:26 What is Gross Profit?

03:13 What is Gross Profit Margin?

04:00 Example: Gross Profit Margin

04:45 Comparison: Year on Year

05:30 Comparison: Different Businesses

06:26 What Decreases Gross Profit Margin?

07:03 What Increases Gross Profit Margin?

🔎FAQ

▪ My Favourite Accounting Book for Beginners → http://geni.us/5mKR7m

🚶FOLLOW ME ON

▪ Insta → https://www.instagram.com/accountingstuff

▪ Twitter → https://twitter.com/AccountantStuff

🎬LEARN ACCOUNTING BASICS FOR FREE

▪ The Full Playlist → https://www.youtube.com/playlist?list=PL5zKSeS09l339nB6ujJPQ9Rsv99_baTb

________________________

DISCLAIMER

Some of the links above are affiliate links, where I earn a small commission if you click on the link and purchase an item. You are not obligated to do so, but it does help fund these videos in hopes of bringing value to you!

________________________

accounting accountingstuff financialratios

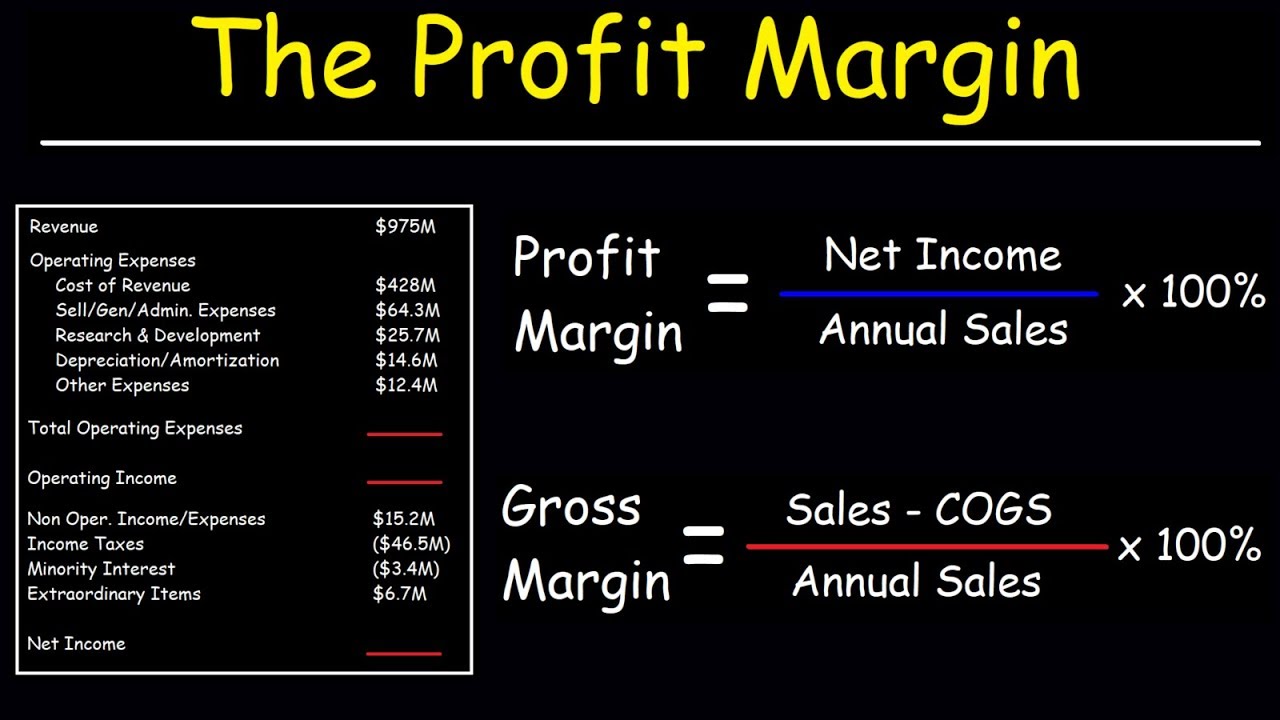

Profit Margin, Gross Margin, and Operating Margin – With Income Statements

This finance video tutorial explains how to calculate the net profit margin, the gross profit margin, and operating profit margin of a company given an income statement. This video includes many examples and practice problems that will help you to learn the concept.

My Website: https://www.videotutor.net

Patreon Donations: https://www.patreon.com/MathScienceTutor

Amazon Store: https://www.amazon.com/shop/theorganicchemistrytutor

Subscribe:

https://www.youtube.com/channel/UCEWpbFLzoYGPfuWUMFPSaoA?sub_confirmation=1

นอกจากการดูหัวข้อนี้แล้ว คุณยังสามารถเข้าถึงบทวิจารณ์ดีๆ อื่นๆ อีกมากมายได้ที่นี่: ดูวิธีอื่นๆBUSINESS & INVESTMENT tại đây