Table of Contents

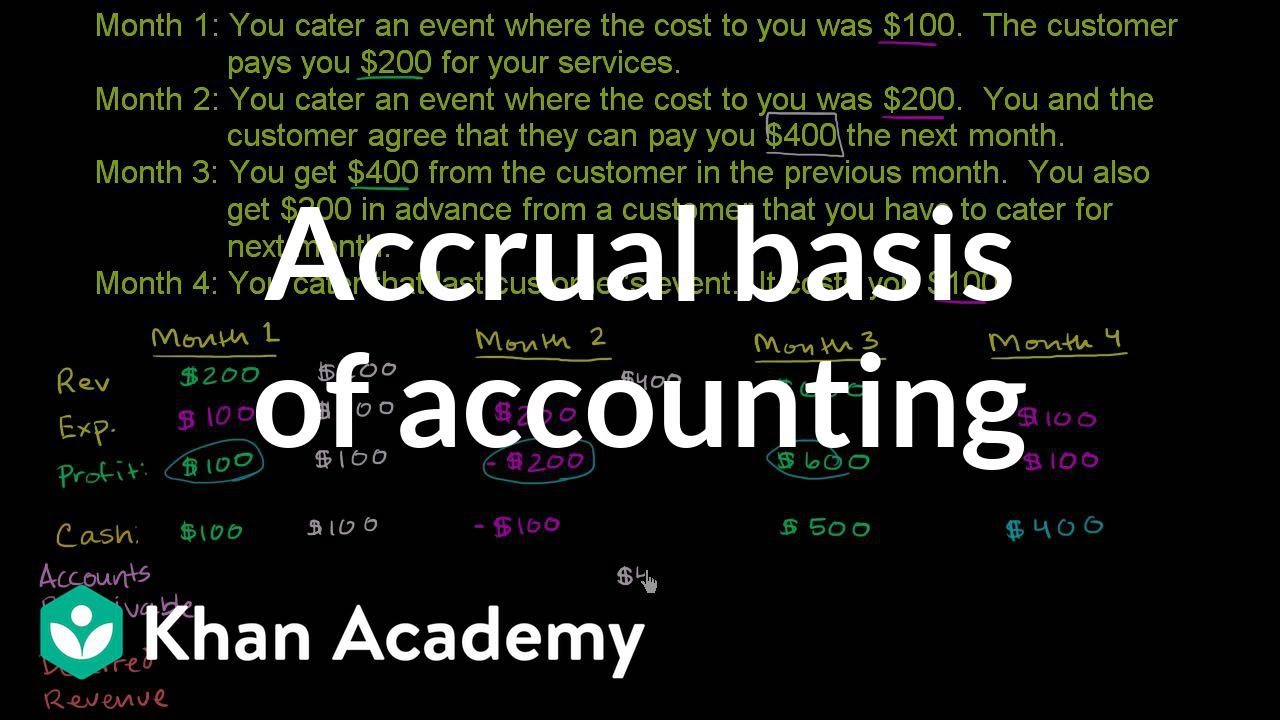

Accrual basis of accounting | Finance \u0026 Capital Markets | Khan Academy

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูเพิ่มเติม

Simple example of accrual accounting. Created by Sal Khan.

Watch the next lesson:

https://www.khanacademy.org/economicsfinancedomain/corefinance/accountingandfinancialstateme/cashaccrualaccounting/v/comparingaccrualandcashaccounting?utm_source=YT\u0026utm_medium=Desc\u0026utm_campaign=financeandcapitalmarkets

Missed the previous lesson? Watch here: https://www.khanacademy.org/economicsfinancedomain/corefinance/accountingandfinancialstateme/cashaccrualaccounting/v/cashaccounting?utm_source=YT\u0026utm_medium=Desc\u0026utm_campaign=financeandcapitalmarkets

Finance and capital markets on Khan Academy: In exchange for being treated as a personlikelegal entity (and the limited liability this gives for its owners), most corporations pay taxes. This tutorial focuses on what corporations are, \”double taxation\” and a few ways that multinationals might try to get out of paying taxes.

About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study at their own pace in and outside of the classroom. We tackle math, science, computer programming, history, art history, economics, and more. Our math missions guide learners from kindergarten to calculus using stateoftheart, adaptive technology that identifies strengths and learning gaps. We’ve also partnered with institutions like NASA, The Museum of Modern Art, The California Academy of Sciences, and MIT to offer specialized content.

For free. For everyone. Forever. YouCanLearnAnything

Subscribe to Khan Academy’s Finance and Capital Markets channel: https://www.youtube.com/channel/UCQ1Rt02HirUvBK2D2ZO_2g?sub_confirmation=1

Subscribe to Khan Academy: https://www.youtube.com/subscription_center?add_user=khanacademy

Cash vs Accrual Accounting Explained With A Story

There are 2 different accounting methods: Cash Accounting and Accrual Accounting. In this video I will show you the difference between accrual basis versus cash basis of accounting by telling you a story. You will get a quick overview how each of these methods impacts the timing of recording a company’s transactions.

In Cash Accounting companies record transactions only when cash is exchanged. This means that revenue is recorded only when cash is received. And expenses are recorded only when cash is paid. Therefore, this method is intuitive and simple to understand. It helps you keep track of your cash balance, easy to apply, and an accepted accounting method also for tax purposes. Cash accounting method can be your accounting method of choice especially if your business is small and simple, and mainly cash based. On the other hand, cash accounting may not provide a full picture of the business at a certain point in time.

In Accrual Accounting companies record transactions when they happen rather than when cash changes hands. Revenue is recorded when earned, meaning when a sale is made and the products or services are delivered to the customer. Even if the customer hasn’t paid yet. Expenses are recorded when incurred regardless even if they’ve not been paid to the supplier yet. Accrual Accounting provides a much better picture of what is happening in a business. If the company reports under GAAP or IFRS then Accrual Accounting is the accepted method. However, it does not focus on cash flows which is why reported income under this method does not equal cashin.

00:56 What is Cash Accounting

02:38 Accrual Accounting Explained

03:27 Cash and Accrual Accounting explained with a Story

09:13 Advantages and Disadvantages for both methods

Check out the full article here: https://www.xelplus.com/cashvsaccrualaccounting

In the next video of our accounting basics series, we’ll take a look at the Cash Flow Statement.

★ My Online Excel Courses ► https://www.xelplus.com/courses/

✉ Subscribe \u0026 get my TOP 10 Excel formulas ebook for free

https://www.xelplus.com/freeebook/

EXCEL RESOURCES I Recommend: https://www.xelplus.com/resources/

Get Office 365: https://microsoft.msafflnk.net/15OEg

Microsoft Surface: https://microsoft.msafflnk.net/c/1327040/451518/7593

GEAR

Camera: https://amzn.to/2FLiFho

Screen recorder: http://techsmith.pxf.io/c/1252781/347799/5161

Microphone: https://amzn.to/2DVKstA

Lights: http://amzn.to/2eJKg1U

More resources on my Amazon page: https://www.amazon.com/shop/leilagharani

Let’s connect on social:

Instagram: https://www.instagram.com/lgharani

Twitter: https://twitter.com/leilagharani

LinkedIn: https://at.linkedin.com/in/leilagharani

Note: This description contains affiliate links, which means at no additional cost to you, we will receive a small commission if you make a purchase using the links. This helps support the channel and allows us to continue to make videos like this. Thank you for your support!

Accounting

Accrual Basis Accounting Definition -What is Accrual Basis Accounting?

Accrual basis accounting definition including break down of areas in the definition. Analyzing the definition of key term often provides more insight about concepts. The term accrual basis accounting can be defined as: Accounting system that recognizes revenues when earned and expenses when incurred; the basis of GAAP. The term accrual basis accounting is the core accounting concept and method used by most businesses and in most textbooks and the accrual method is the method of GAAP. The accrual method can be contrasted against the cash method, the accrual method recognizing revenue when earned and expenses when incurred, the cash method recognizing revenue and expense when cash is received and paid. The accrual method is more accurate in that it pinpoints the point when revenue was earned and when expenses incurred.

Why Learn Accounting Financial Accounting / Managerial Accounting

https://youtu.be/uaWDB1YdA1k?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Double Entry Accounting System Explained Accounting Equation

https://youtu.be/66e9QbrkE4g?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Cash vs Accrual Cash Method / Accrual method differenc

https://youtu.be/i2O0cexCrqc?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Revenue Recognition Principle

https://youtu.be/M_pauBGz5Jc?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

Double Entry Accounting System Explained Balance Sheet

https://youtu.be/kOItl8E3fNA?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Income Statement Introduction

https://youtu.be/1k11H8icQxc?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Accounting Objectives Relevance Reliability Comparability

https://youtu.be/mO8tPzFmN8o?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Transaction Rules Accounting Equation

https://youtu.be/0vy6W_WTO2I?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Transaction Throught Process / Steps Accounting Equation

https://youtu.be/SlTo3EXDuqU?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Owner Deposits Cash Transaction Accounting Equation

https://youtu.be/lPZoImc88eU?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

101 Work Completed for Cash Transaction Accounting Equation

https://youtu.be/ll5xIHVdrVs?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

100.110 Pay Employee with Cash Transaction Accounting Equati

https://youtu.be/bSa3NuVpkwc?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

200 Debits \u0026 Credits Normal Balance Double Entry Accounting Sy

https://youtu.be/alSWKuWPlxU?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

200 Debits \u0026 Credits One Rule to Rule Them All

https://youtu.be/RL3BFjL1eyE?list=PL60SIT917rv52SlrB3FFn2WMyZEkj6uBI

Understand how to enter Accruals \u0026 Prepayments transactions using the Double Entry System

Understand how to enter Accruals/Prepayments of Revenue and Expenses into ‘T’ accounts using the double entry system. By watching this video you will be shown how to enter Amounts Owing and Due into the General Ledger ‘T’ Accounts. If you would like to download the Handout on how to enter Accruals and Prepayments transactions into ‘T’ accounts using the double entry system then please visit our Website at http://www.igcseaccounts.com/.

Financial Accounting 101: Accruals and Deferrals – Accrual Accounting – Made Easy

This is the lesson that helped me to understand deferrals and accruals. Think of Deferrals as ‘Dollars before Action’ and Accruals as ‘Action before Dollars.’

Deferred Expense Asset: Prepaid Expense

Think of this as an expense where we paid Dollars before the Action of incurring the expense. Our vendors owe us, this is an asset.

Deferred Revenue Liability: Unearned Revenue

Think of this as revenues that we accepted Dollars before the Action of earning them. We owe our customers, this is a liability.

Accrued Expense Liability: Account Payable

Think of this as a time when the Action of incurring an expense came before the Dollars we need to pay. We owe our vendors money, this is a liability.

Accrued Revenues Asset: Account Receivable

Think of this as the Action of earning the revenues came before receiving the Dollars we need to collect. Our customers owe us money, this is an asset.

นอกจากการดูหัวข้อนี้แล้ว คุณยังสามารถเข้าถึงบทวิจารณ์ดีๆ อื่นๆ อีกมากมายได้ที่นี่: ดูบทความเพิ่มเติมในหมวดหมู่BUSINESS & INVESTMENT tại đây